The Importance of Cash Flow Forecasting for New Businesses

Did you know that a staggering 82% of new businesses fail due to poor cash flow management? (Metrics, May 2023). This underscores the importance of cash flow forecasting for a company’s success.

In entrepreneurship, reliable cash flow forecasting isn’t just a tool; it’s a lifeline. Imagine the heartache of pouring your dreams, sweat, and savings into a startup, only to be blindsided by unexpected financial turbulence.

The harsh reality is that without a crystal-clear vision of where your money is flowing, your business is navigating blindfolded through the stormy seas of uncertainty.

But here’s the silver lining: mastering cash flow forecasting can be the game-changer that separates the survivors from the fallen. It’s not just about surviving; it’s about thriving, scaling, and turning those entrepreneurial dreams into a sustainable reality.

Hence, for new businesses, managing cash flow is crucial to their success and long-term sustainability.

Cash flow, the movement of money in and out of a company, is the lifeblood of any organization, and it is especially critical for startups and small enterprises that may have limited resources and face greater financial uncertainties.

In this article, we’ll explore why cash flow forecasting is important for business success, and how it can propel your venture toward a future of financial stability and growth.

Understanding the Importance of Cash Flow Forecasting

Effective cash flow forecasting is crucial for the success of new and existing businesses, as it provides valuable insights into future financial performance and enables proactive decision-making.

What is a cash flow?

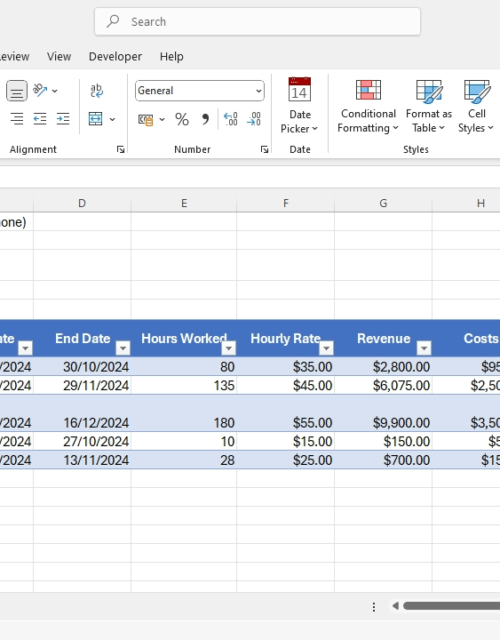

A cash flow forecast is a financial projection that estimates the amount of money flowing in and out of a business over a specific period, typically ranging from 12 to 52 weeks. This forecast takes into account expected sales, expenses, investments, and other cash-related activities, providing a clear picture of the company’s future liquidity and financial health.

Cash flow, in simple terms, means the movement of cash in and out of a business. To make it clearer, let’s distinguish the following.

Profit vs. Cash Flow:

While often used interchangeably, profit and cash flow are distinct concepts. Let me explain:

- Profit: This refers to the net income or loss of a business over a specific period. It’s calculated by subtracting total expenses from total revenue.

- Cash Flow: This measures the actual movement of money into and out of a business. It’s concerned with the timing of cash receipts and payments, regardless of when revenue is earned or expenses are incurred.

To illustrate the difference, consider a small business that sells products on credit. The business might generate significant profits from sales, but if customers delay payments, the business may face cash flow challenges.

Components of Cash Flow:

Cash flow is influenced by two primary factors, namely inflows and outflows.

- Cash Inflows: These are the sources of cash entering the business (Things that bring money into the business). Common examples include:

- Sales revenue

- Loan and grant proceeds

- Investment income

- Sale of business assets

- Think of other things as they pertain to your business and use the comment box to intimate us, of additions.

- Cash Outflows: These are the expenditures of cash from the business (Things that take money out of the business). Common examples include:

- Purchase of inventory

- Payment of salaries and wages

- Rent and utility expenses

- Taxes

- Loan repayments

- Purchase of equipment

- There are more. Take a closer look at your business and inform us what other things consume your capital outside what has been mentioned.

- Net Cash Flow: The difference between cash inflows and cash outflows, indicating the overall change in a company’s cash position.

Common Cash Flow Challenges for New Businesses

New businesses, particularly startups, often face unique cash flow challenges including:

- Initial Investment: The initial costs of setting up a business, such as rent, equipment, and inventory, can drain cash reserves.

- Delayed Receivables: Customers not paying their invoices on time can create significant cash flow issues.

- Overestimating Sales: Overly optimistic sales forecasts can lead to overspending on inventory, staff, or other expenses.

- High Overheads: Fixed costs like rent and salaries can drain cash reserves if not managed carefully.

- Seasonal Fluctuations: Seasonal businesses may face periods of low cash flow during off-peak times.

- Unexpected Expenses: Emergencies or unexpected costs (e.g., equipment breakdown) can impact cash reserves.

- Insufficient Financing: Limited access to credit or funding can hinder a business’s ability to smooth out cash flow variations.

To succeed and grow sustainably, businesses (new and existing) should learn how to effectively manage these components. Also, forecasting cash flow accurately is crucial for startups to ensure they can meet their financial obligations in the future.

Reasons Why Cash Flow Forecasting is Important

Cash flow forecasting is a crucial financial management tool for any business, especially new ventures. It provides several key benefits.

By predicting future cash inflows and outflows, businesses can make informed decisions, mitigate risks, and optimize their financial performance. In this section, we’ll consider why cash flow forecasting is important for business success.

Predicting Future Financial Performance:

Being proactive is key to business success. One of the primary reasons for cash flow forecasting is to ensure that the business maintains adequate liquidity to meet its obligations. This is one major importance of cash flow forecasting to businesses.

By predicting cash inflows and outflows, businesses can identify potential shortfalls and take proactive measures to address them. This helps in avoiding situations where the company may run out of cash, which can be catastrophic for new businesses.

Thus, anticipating cash shortages and surpluses can help a business avoid risks and capitalize on opportunities. Effective cash flow forecasting will help businesses:

- Anticipate Cash Shortages or Surpluses: By forecasting future cash flows, businesses can identify potential periods of cash scarcity or abundance. This enables them to plan accordingly, whether it’s securing additional funding or investing in growth opportunities.

- Identify Potential Risks and Opportunities: Cash flow forecasting can highlight potential risks, such as unexpected expenses or delayed payments. It can also uncover opportunities, such as early payment discounts or strategic investments.

- Make Informed Decisions about Investments and Expenses: With a clear picture of future cash flows, businesses can make informed decisions about capital expenditures, hiring, and marketing initiatives.

Another importance of Cash Flow Forecasting is in Securing Funding:

Funding is crucial to the success and scaling of every business. To ensure that such funds are adequately utilized, cash flow forecasting is important. For example, it helps at:

- Convincing Investors and Lenders of the Business’s Viability: A well-prepared cash flow forecast demonstrates a business’s financial discipline and its ability to manage cash effectively. This can significantly improve the chances of securing funding from investors or lenders.

- Demonstrating a Clear Understanding of Financial Projections: Investors and lenders are more likely to support businesses that have a solid understanding of their financial future. A detailed cash flow forecast can instill confidence in the business’s ability to repay loans or deliver returns to investors.

- Avoiding Debt and Minimizing Interest: Accurate cash flow forecasts can help businesses avoid unnecessary borrowing. By knowing in advance when additional funds will be needed, companies can seek out the most cost-effective financing options or make timely adjustments to reduce expenses. This proactive approach helps minimize interest payments and reduce overall debt levels.

Improving Operational Efficiency:

Improving operational efficiency is another crucial factor that depicts the importance of cash flow forecasting. Effective cash flow forecasting is essential to a business’s operational efficiency in the following ways.

- Optimizing Inventory Levels and Purchasing Decisions: By forecasting future demand, businesses can optimize their inventory levels, avoiding both stockouts and excess inventory costs.

- Managing Accounts Receivable and Payable Effectively: Cash flow forecasting helps businesses prioritize payments and collections, ensuring a steady inflow of cash.

Strategic Planning:

Cash flow forecasting allows business owners to plan strategically for the future. By understanding when cash will be available, businesses can make informed decisions about when to invest in new opportunities, hire additional staff, or expand operations. This foresight helps in aligning financial resources with the company’s growth ambitions. For example,

- Aligning Financial Goals with Overall Business Strategy: Cash flow forecasting allows businesses to align their financial goals with their broader strategic objectives.

- Developing Contingency Plans for Unexpected Events: By identifying potential risks, businesses can develop contingency plans to mitigate their impact on cash flow.

- Managing Surplus Cash: Effective cash flow forecasting not only helps in managing deficits but also in handling surplus cash. Businesses can identify periods of excess cash flow and decide how best to utilize these funds, whether it’s reinvesting in the business, paying down debt, or creating a reserve for future uncertainties.

Improving Relationships with Stakeholders:

- Regular and accurate cash flow forecasting builds credibility with stakeholders, including investors, banks, and suppliers. It demonstrates that the business is well-managed and financially sound, which can lead to better terms of credit, improved supplier relationships, and increased investor confidence.

Identifying Trends and Patterns

- By continuously monitoring and forecasting cash flow, businesses can identify trends and patterns in their financial activities. This can provide valuable insights into seasonal fluctuations, customer payment behaviors, and other factors that impact cash flow. Such insights enable businesses to make more informed decisions and improve their financial management practices.

Crisis Management

- In times of crisis, whether economic downturns or unexpected expenses, having a clear cash flow forecast can be a lifesaver. It provides a roadmap for navigating through tough times, helping businesses make critical decisions quickly and effectively. This preparedness can be the difference between survival and failure.

In summary, cash flow forecasting is not just a financial exercise; it is a strategic tool that underpins the stability and growth of a business. For new businesses, in particular, mastering cash flow forecasting can significantly enhance their chances of success and sustainability.