Ultimate Cash Flow Forecasting Methods: Tools, Techniques, and Best Practices

If you’ve been in business, you would’ve understood that cash is king. EarthWeb says that 47% of businesses fail due to poor cash flow. You can have a brilliant idea, a groundbreaking product, and a dedicated team but all can be rendered useless if your business cash flow runs dry.

Many businesses fail not because they lack potential but because they fail to manage their cash effectively. In December 2022, Lifestyle retailer Joules announced plans to liquidate due to cash-flow difficulties despite making a profit of £2.6 million during the previous year. This is where the power of cash flow forecasting and cash flow forecasting methods comes in.

Cash flow forecasting is the process of estimating the amount of cash that will flow into and out of your business over a specific period. It’s more than just guessing; it’s a strategic process that involves analyzing historical data, projecting future revenues and expenses, and understanding the timing of those cash flows. A well-executed cash flow forecast provides a roadmap for your financial future, enabling you to make informed decisions, secure funding, and avoid potential cash crunches.

This ultimate guide will equip you with the knowledge and tools you need to master cash flow forecasting. We’ll delve into various forecasting methods, explore the software solutions that can streamline the process (including popular options like FreeAgent and Xero), and share practical tips for creating accurate and actionable forecasts.

For those who are new to the concept or want a refresher on the fundamentals, we’ve also covered the essential questions of what cash flow forecasting is and why it’s so critical for business success in separate articles. You can learn more about the definition of cash flow forecasting and why it is essential for every business here. Now, let’s dive into the core of effective cash flow forecasting methods.

What is Cash Flow Forecasting?

Cash flow forecasting is the process of projecting the amount of cash expected to come into and go out of your business over a specific period. It’s a crucial financial exercise that helps you understand your business’s ability to generate cash and meet its obligations.

Unlike profit, which is an accounting measure of revenue minus expenses, cash flow focuses on the actual movement of money. A profitable business can still struggle if it doesn’t manage its cash flow effectively.

Understanding the difference between profit and cash flow is fundamental to effective financial management. For a detailed explanation of what cash flow forecasting is, the key differences between cash flow and profit, and why this distinction is so important, please see this article: The Importance of Cash Flow Forecasting for New Businesses.

Why is Cash Flow Forecasting Important?

Cash flow forecasting is essential for businesses of all sizes, from startups to established enterprises. Accurate forecasts empower you to make informed decisions about your financial future. They are instrumental in securing funding from investors or lenders, as they demonstrate your ability to manage your finances responsibly.

Furthermore, cash flow forecasts can help you identify potential cash shortages or other financial problems before they become crises, allowing you to take proactive steps to mitigate risks. They also play a crucial role in budgeting, financial planning, and even business valuation.

To learn more about the importance of cash flow forecasting and its far-reaching impact on business success, please see this article: The Importance of Cash Flow Forecasting for New Businesses.

Different Cash Flow Forecasting Methods

There are several methods for forecasting cash flow, each with its own approach and level of complexity. Choosing the right method depends on your business size, industry, and the level of detail you need.

A. Direct Cash Flow Forecasting Methods

The direct method is the most straightforward approach. It involves projecting cash inflows and outflows directly. You essentially list all the anticipated cash receipts and cash payments for the forecast period.

- How it works:

- Project Cash Inflows: Forecast sales revenue, collections from customers (consider payment terms), and any other cash receipts (e.g., interest income, asset sales. etc).

- Project Cash Outflows: Forecast cash payments for expenses like rent, salaries, inventory purchases, utilities, loan repayments, and other operating costs.

- Calculate Net Cash Flow: Subtract total cash outflows from total cash inflows for each period (e.g., monthly, quarterly, yearly).

- Calculate Ending Cash Balance: Add the net cash flow for each period to the beginning cash balance for that period. This gives you the projected ending cash balance.

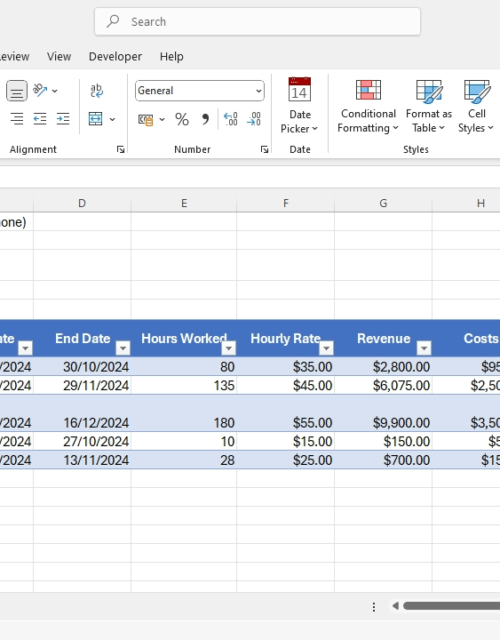

- Example: Let’s say you own a small bakery. You’re forecasting cash flow for the next month (March). The tabulation is as follows:

| Category | Description | Amount |

| Cash Inflows | Projected Sales | $10,000 |

| Collections from wholesale customers | $2,000 | |

| Total Cash Inflows | $12,000 | |

| Cash Outflows | Rent | $1,000 |

| Ingredients | $3,000 | |

| Salaries | $2,000 | |

| Utilities | $500 | |

| Marketing | $500 | |

| Total Cash Outflows | $7,000 | |

| Net Cash Flow | Total Cash Inflows – Total Cash Outflows | $5,000 |

| Beginning Cash Balance (March 1st) | $3,000 | |

| Projected Ending Cash Balance (March 31st) | Beginning Cash Balance + Net Cash Flow | $8,000 |

This table clearly outlines the cash inflows, cash outflows, and the calculations leading to the projected ending cash balance for the month of March.

- Advantages of direct method:

- Simple and easy to understand.

- Provides a clear picture of cash inflows and outflows.

- Useful for short-term forecasting.

- Easier to compare with other companies’ cash flow statements.

- Offers in-depth details on the sources of cash inflows and destinations of cash outflows.

- Disadvantages of direct method:

- Can be time-consuming for businesses with many transactions.

- Doesn’t directly show the relationship between profit and cash flow.

- Can be less accurate for long-term forecasting due to the difficulty in predicting individual cash transactions far into the future.

B. Indirect Cash Flow Forecasting Methods

The indirect method starts with net income (from the income statement) and adjusts it for non-cash items and changes in balance sheet accounts to arrive at cash flow from operating activities.

- How it works:

- Start with Net Income: Take the net income figure from your projected or historical income statement.

- Adjust for Non-Cash Items: Add back non-cash expenses like depreciation and amortization.

- Adjust for Changes in Current Assets and Liabilities:

- Increase in current assets (like accounts receivable or inventory) is a use of cash (subtract).

- Decrease in current assets is a source of cash (add).

- Increase in current liabilities (like accounts payable) is a source of cash (add).

- Decrease in current liabilities is a use of cash (subtract).

- Example: Let’s assume your bakery’s net income for February is projected to be $4,000.

- Adjustments:

- Depreciation (a non-cash expense) $500 (add back)

- Amortization (an intangible asset) $200

- Increase in Accounts Receivable: $1,000 (subtract)

- Decrease in Inventory: $500 (add)

- Increase in Accounts Payable: $1,500 (add)

- Calculation:

- Cash Flow from Operating Activities: $4,000 + $500 + $200 – $1,000 + $500 + $1,500 = $5,700

Here is the table for the indirect cash flow forecasting method using the estimates provided for your bakery in February:

| Category | Amount |

| Net Income | $4,000 |

| Depreciation | +$500 |

| Amortization | +$200 |

| Increase in Accounts Receivable | -$1,000 |

| Decrease in Inventory | +$500 |

| Increase in Accounts Payable | +$1,500 |

| Net Cash Flow from Operating Activities | $5,700 |

This table captures the adjustments made to the net income to arrive at the cash flow from operating activities for February using the indirect method.

- Advantages of indirect method:

- Shows the relationship between profit and cash flow.

- Useful for understanding how changes in working capital affect cash flow.

- Often easier to use if you have accurate financial statements.

- Commonly used in financial reporting, making it easier to compare with other companies.

- Disadvantages of indirect method:

- Can be more complex than the direct method.

- Requires a good understanding of accounting principles.

- Less useful for very short-term (daily/weekly) cash flow projections.

C. Rolling Forecasts Method

A rolling forecast involves continuously updating your cash flow forecast regularly (e.g., weekly, monthly, or quartely). Instead of creating a fixed forecast for a set period (e.g., one year), you add a new period to the forecast as each period is completed. This ensures that the forecast always covers a specific future time horizon, such as 12 months.

- How it works: If you’re using a 12-month rolling forecast, at the end of each month, you drop the oldest month from the forecast and add a new month at the end. This keeps your forecast horizon always 12 months out.

- Example: At the end of February, you would remove the original February forecast from your forecast and add a new forecast for February of the following year.

- Let’s say your bakery business creates a 12-month forecast for the year 2025. The forecast includes projected sales, expenses, and cash flows for each month from January to December 2025.

- Updating the Forecast:

- At the end of January 2025, your bakery reviews actual sales and expenses for January and updates the forecast. They add projections for January 2026, ensuring the forecast always covers the next 12 months.

- Calculation:

- January 2025 actual sales: $20,000

- January 2025 forecasted sales: $15,000

- Difference: +$5,000

- Updated forecast for February 2025: Adjust based on January’s performance and new market data.

- Adapting to Changes:

- In February 2025, you learn about a new technology trend that is expected to boost sales. You incorporate this information into your rolling forecast, adjusting sales projections for the upcoming months.

- Calculation:

- Previous February 2025 forecasted sales: $30,000

- Adjusted February 2025 forecasted sales: $40,000 (considering the new trend)

- Scenario Analysis:

- You perform scenario analysis by creating different scenarios (e.g., best-case, worst-case) based on various market conditions and adjust forecasts accordingly.

- Calculation:

- Best-case scenario (new trend highly successful): March 2025 forecasted sales: $50,000

- Worst-case scenario (new trend less successful): March 2025 forecasted sales: $45,000

- Advantages of the rolling method:

- It allows businesses to continuously adapt to changes in the market, economy, and internal operations.

- Generally more accurate than static forecasts, especially for longer time horizons.

- Rolling forecasts provide a long-term view of financial performance, helping businesses plan for future growth and challenges.

- Encourages regular review and updates of the forecast.

- By regularly updating forecasts, businesses can make informed decisions based on the most current data.

- Businesses can explore different scenarios and their potential impacts, leading to better risk management.

- Disadvantages of the rolling method:

- Requires more time and effort than creating a single static forecast.

Coca-Cola is an example of a company that uses quarterly rolling forecasts to stay agile and responsive to changes in the beverage industry.

D. Other Methods

Scenario planning method

Scenario planning is a cash flow forecasting method that involves creating multiple cash flow projections based on different potential future scenarios. This method helps businesses prepare for various uncertainties and develop strategies to manage risk.

For example:

- Base Case Scenario: Cash flow projections can be made based on current market trends. Your business could have the following cumulative cash flow projection:

- Monthly Sales: $50,000

- Monthly Expenses: $40,000

- Net Cash Flow: $10,000

- Best Case Scenario: Cash flow is prepared using the most palatable possible scenario. Projections could be as follows:

- Monthly Sales: $80,000

- Monthly Expenses: $50,000

- Net Cash Flow: $30,000

- Worst Case Scenario: Finally, you may foresee a situation where unexpected occurrences may lead to a loss in market share, and present the following cash flow:

- Monthly Sales: $30,000

- Monthly Expenses: $40,000

- Net Cash Flow: -$10,000

By preparing for different scenarios, you can develop strategies to manage risks and seize opportunities, such as adjusting marketing efforts or securing additional funding.