Ultimate Cash Flow Forecasting Methods: Tools, Techniques, and Best Practices

3-Statement model method

The 3-statement model integrates the income statement, balance sheet, and cash flow statement to provide a comprehensive view of a business’s financial health. This method is more complex but provides a comprehensive view and ensures consistency and accuracy across all financial projections.

For Example: Let’s use the following income statement and balance sheet of your company to create a cash flow statement.

- Income Statement Projections:

- Revenue: $500,000

- COGS: $300,000

- Operating Expenses: $100,000

- Net Income: $100,000

- Balance Sheet Projections:

- Assets: $1,000,000

- Liabilities: $400,000

- Equity: $600,000

- Cash Flow Statement Projections:

- Cash Flow from Operating Activities: $150,000

- Cash Flow from Investing Activities: -$50,000

- Cash Flow from Financing Activities: $0

- Net Cash Flow: $100,000

By integrating all three statements, you ensure that your business’s financial projections are aligned and accurate.

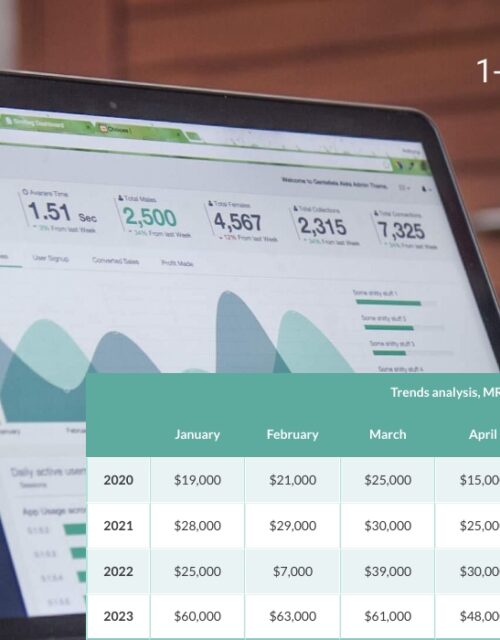

Trend analysis method

Trend analysis involves examining historical cash flow data to identify patterns and trends. This method helps businesses predict future cash flows based on past performance.

Example: Let’s assume that your bakery business has the following 2 year data.

- Historical Data:

- Year 1:

- Q1: $20,000

- Q2: $25,000

- Q3: $30,000

- Q4: $35,000

- Year 2:

- Q1: $22,000

- Q2: $27,000

- Q3: $32,000

- Q4: $37,000

- Year 1:

- Identifying Trends: To identify trends, we compute the growth rate per quarter. The data shows a 10% growth rate for quarter 1, and 8% for quarter 2.

- Calculation:

- Q1 Growth: (22,000 – 20,000) / 20,000 * 100% = 10%

- Q2 Growth: (27,000 – 25,000) / 25,000 * 100% = 8%

- Q3 Growth: (32,000 – 30,000) / 30,000 * 100% = 6.67%

- Q4 Growth: (37,000 – 35,000) / 35,000 * 100% = 5.71%

- Calculation:

- Forecasting Future Cash Flows: Using the estimated growth rates per quarter, you can project the cash flow for the next year’s quarters as follows.

- Projection:

- Q1: $22,000 * 1.10 = $24,200

- Q2: $27,000 * 1.08 = $29,160

- Q3: $32,000 * 1.07 = $34,240

- Q4: $37,000 * 1.06 = $39,220

- Projection:

Using historical data, you can make informed predictions about future cash flows and plan accordingly.

These examples illustrate how you can apply different cash flow forecasting methods in real-world scenarios to help manage your business finances effectively.

Cash Flow Forecasting Tools & Software

While manual cash flow forecasting can be done with pen and paper, leveraging software tools significantly enhances accuracy, efficiency, and the ability to analyze different scenarios. Here’s a look at some popular options you can use:

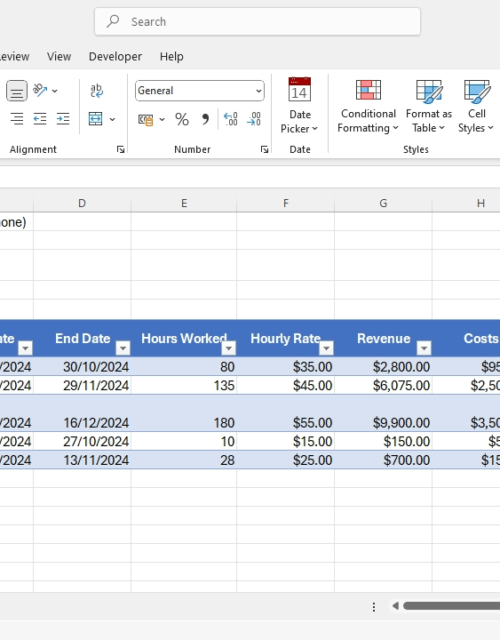

A. Spreadsheets (Excel/ Google Sheets)

Spreadsheets like Microsoft Excel and Google Sheets offer a flexible and accessible way to create basic cash flow forecasts. Their strength lies in their customizability. You can build your own forecasting templates and formulas, tailoring them to your specific needs.

- How they’re used:

- You can set up columns for different periods (e.g., weeks, months) and rows for various cash inflows and outflows variables. Formulas can then be used to calculate net cash flow and ending balances.

- Advantages of spreadsheets:

- Flexibility: Spreadsheets are highly customizable.

- Accessibility: Most businesses already have access to spreadsheet software.

- Cost-effective: Depending on the spreadsheet software you choose, it is often included with other software subscriptions or can be free.

- Disadvantages of spreadsheets:

- Manual Data Entry: This can be time-consuming and prone to errors.

- Limited Automation: It requires manual updates and calculations.

- Version Control Issues: It may be difficult to track changes and collaborate on forecasts.

- Not Ideal for Complex Scenarios: This may become cumbersome for larger businesses or complex forecasting needs.

B. Accounting Software

Cloud-based accounting software like FreeAgent and Xero offers integrated cash flow forecasting features, making it easier to connect your financial data to your projections.

- FreeAgent: FreeAgent is particularly popular with freelancers and small businesses. Its cash flow forecasting tool integrates directly with your accounting data, automatically pulling in your income and expenses to generate forecasts. It offers a visual representation of your cash flow, making it easy to spot potential shortfalls.

- How it’s used: FreeAgent’s cash flow forecast is updated in real-time as you record transactions. You can adjust assumptions about future income and expenses to see their impact on your cash flow.

- Advantages: Easy to use, integrates with accounting data, real-time updates.

- Disadvantages: May not be suitable for larger businesses with complex forecasting needs. The feature set is tailored towards small businesses.

- Xero: Xero also offers cash flow forecasting features, often as part of its reporting or financial analysis tools. Like FreeAgent, it leverages your accounting data to create projections. Xero may offer more advanced reporting and scenario planning options compared to FreeAgent, depending on the Xero plan.

- How it’s used: Xero allows you to project cash flow based on existing invoices, bills, and other financial transactions. You can also create “what-if” scenarios to explore different possibilities. Xero’s reporting functionality can then be used to generate cash flow reports.

- Advantages: Integrates with accounting data, offers reporting features, and can handle larger businesses.

- Disadvantages: Cash flow forecasting functionality might require a higher-tier subscription. Can be more complex to set up compared to FreeAgent.

While both FreeAgent and Xero offer cash flow forecasting, FreeAgent is generally considered more user-friendly and specifically designed for very small businesses. Xero, with its broader feature set, is a better fit for growing businesses that need more robust reporting and financial management capabilities. The best choice depends on the size and complexity of your business, as well as your budget.

C. Specialized Forecasting Software

For businesses with highly complex forecasting needs, or those seeking deeper integration and automation, specialized software solutions are available. These tools often offer advanced features like driver-based forecasting, what-if analysis, and integration with other business systems. Here are some examples:

- Float: Float is a dedicated cash flow forecasting tool designed to integrate seamlessly with popular accounting software like Xero, QuickBooks, and FreeAgent. Its strength lies in its ability to automate the data import process, pulling in your financial transactions to create real-time cash flow forecasts. Float provides visual dashboards and reports, making it easy to see your projected cash position and identify potential shortfalls. It also offers scenario planning features, allowing you to model different outcomes based on varying assumptions. Float is particularly well-suited for businesses that want to move beyond basic spreadsheet forecasting and need a more automated and insightful approach.

- Futrli: Futrli is a comprehensive financial forecasting and reporting platform that goes beyond just cash flow. While it offers robust cash flow forecasting capabilities, it also provides tools for creating profit and loss forecasts, balance sheet projections, and other financial reports. Futrli integrates with accounting software and allows you to create custom dashboards and reports. It also offers advanced features like driver-based forecasting, which allows you to link your financial projections to key business drivers (e.g., sales volume, customer acquisition cost). Futrli is a good option for businesses that need a more holistic view of their financial future and want to connect their cash flow forecasts to broader strategic planning.

- PlanGuru: PlanGuru is a financial planning and analysis (FP&A) software that includes robust cash flow forecasting capabilities. It’s designed for small to mid-sized businesses and offers features like forecasting multiple scenarios, creating custom reports, and integrating with QuickBooks and Xero. PlanGuru is known for its user-friendly interface and its ability to handle more complex forecasting models.

- CashAnalytics: CashAnalytics focuses specifically on cash flow forecasting and management. It automates the process of collecting and consolidating financial data from various sources, providing real-time visibility into your cash position. CashAnalytics is particularly useful for businesses with multiple entities or complex cash flow structures.

- Pulse: Pulse is a cash flow forecasting software designed for startups and small businesses. It offers a simple and intuitive interface, making it easy to create and manage forecasts. Pulse integrates with popular accounting software and provides visual dashboards to track your cash flow. It emphasizes ease of use and quick setup.

- DryRun: DryRun is a cash flow forecasting tool that emphasizes simplicity and ease of use. It integrates with accounting software and allows you to quickly create and update forecasts. DryRun offers scenario planning features and provides visual dashboards to track your cash position. It’s a good option for small businesses that need a straightforward and affordable cash flow forecasting solution.

The above provides a more comprehensive overview of specialized forecasting software options, catering to different business needs and budgets.