Ultimate Cash Flow Forecasting Methods: Tools, Techniques, and Best Practices

Tips for Effective Cash Flow Forecasting

Creating accurate and useful cash flow forecasts is an ongoing process, not a one-time event. Here are some practical tips to maximize the effectiveness of your forecasting efforts:

- Regularly Update Your Forecasts: Cash flow is dynamic. Market conditions, customer behavior, and internal operations can change quickly. Regularly update your forecasts (e.g., weekly, monthly) to reflect these changes and maintain accuracy. A rolling forecast approach, as discussed earlier, is a great way to ensure continuous updates.

- Use Realistic Assumptions: Avoid overly optimistic or pessimistic projections. Base your assumptions on historical data, market research, and realistic expectations for future performance. Review your assumptions regularly and adjust them as needed. It’s better to be slightly conservative than overly optimistic, as this helps you prepare for potential challenges.

- Involve Key Personnel: Cash flow forecasting shouldn’t be a siloed activity. Involve key personnel from different departments (sales, finance, operations) to get a comprehensive view of your business. Their input can provide valuable insights into potential cash inflows and outflows.

- Monitor Your Actual Cash Flow Against Your Forecasts: Regularly compare your actual cash flow to your forecasts. This helps you identify variances and understand why they occurred. Analyzing these variances allows you to refine your forecasting methods and improve accuracy over time.

- Be Prepared to Adjust Your Forecasts as Needed: Don’t be afraid to adjust your forecasts when new information becomes available. Flexibility is crucial in cash flow forecasting. If your assumptions prove to be incorrect or unexpected events occur, update your forecasts to reflect the new reality.

Common Mistakes to Avoid

Even with the best intentions, some common pitfalls can derail your cash flow forecasting efforts. Be aware of these mistakes and avoid them:

- Overly Optimistic Projections: It’s tempting to project rosy scenarios, but overly optimistic projections can lead to cash shortages and financial distress. Always strive for realism in your assumptions.

- Ignoring Seasonality: Many businesses experience seasonal fluctuations in sales and expenses. Failing to account for these seasonal variations can lead to inaccurate forecasts and cash flow problems during lean periods.

- Not Accounting for Unexpected Expenses: Unexpected expenses, such as equipment repairs or legal fees, can arise at any time. Build a buffer into your forecasts to account for these contingencies.

- Relying on Outdated Data: Using outdated data for your forecasts can lead to inaccurate projections. Ensure that you are using the most current financial information available.

- Not Regularly Reviewing and Updating Forecasts: As mentioned earlier, cash flow forecasting is an ongoing process. Failing to regularly review and update your forecasts can render them useless.

Conclusion

Cash flow forecasting is not just a financial exercise; it’s a strategic imperative for business success. By accurately projecting your cash inflows and outflows, you gain valuable insights into your financial health, enabling you to make informed decisions, secure funding, and navigate the challenges of the business world.

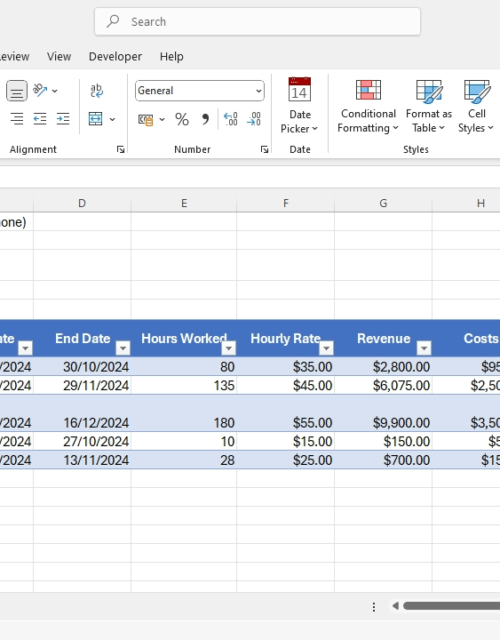

This guide has provided a comprehensive overview of various cash flow forecasting methods, from the direct and indirect approaches to rolling forecasts and scenario planning. We’ve also explored the range of tools available, from basic spreadsheets to specialized software solutions like FreeAgent, Xero, Float, and Futrli, empowering you to choose the best fit for your business needs.

Remember that effective cash flow forecasting requires discipline, realistic assumptions, and a willingness to adapt. By implementing the tips and avoiding the common mistakes outlined in this guide, you can unlock the power of cash flow forecasting and steer your business toward a future of financial stability and growth.

Take action today to implement robust cash flow forecasting practices, and you’ll be well on your way to achieving your business goals.